I have previously explained how to use a free open source accounting program called GnuCash at this link: https://futuretechbizclub.org/course-2-organize-your-business/section-2-business-accounting/lesson-2-3-how-to-keep-track-of-business-funds

In this article, I will review an open source tax preparation program called Open Tax Solver (OTS). OTS is a free, secure and easy-to-use program for calculating and submitting your US Federal taxes (it also does some state taxes). OTS includes updated versions for US 1040, Schedules A, B, C, D, and for several states. OTS provides a simple graphical interface for quickly filing out your tax forms.

Why You Should Consider Doing Your Taxes with OTS

Perhaps the biggest advantage of OTS is that it is the best way to protect the security of your data. You should be aware that, due to open back doors present on all Windows computers, it is simply not safe to store your data including bank accounts and passwords on a Windows computer. Because of this problem, many people have switched to the free and more secure Linux platform. Unlike many commercial programs, OTS is available in a version for use on Linux computers. (note: OTS is also available for Windows and Mac computers just in case you have not yet made the change to Linux).

Equally important for the security of your data, OTS is an open source program. This means the code has been inspected to reduce the chances of vulnerabilities that can be exploited by hackers.

In addition, none of your data is stored on any server or by any commercial operation. It is all stored only on your own personal computer and under your complete control. None of it is ever entered into any web based data system. Thus, it is the perfect alternative to insecure web based programs – including the IRS e filing program.

By contrast, when using web based programs, you have no idea who is getting your data, how they are storing it and whether or not it will eventually wind up in the hands of hackers. Every year, millions of people have their data stolen by hackers. The only way to reduce this problem is to not put your personal and business data on the Internet in the first place.

Another benefit of OTS is that it is free for personal and commercial use. If you have a small business that generates some of your income and you need to fill out Schedule C or Schedule C-EZ, you can do this with OTS without paying any fees.

By contrast, virtually all commercial tax programs that offer a free option, require you to pay for filing even a small amount of business income. Commercial tax prep programs have many other situations where you will need to pay a fee even if you have no business income. This includes things like charging if you have dependents, charging to file schedules 1, 2, 3, charging if you make over a certain amount, charging you for the child tax credit, the earned income credit, the elderly or disabled credit, charging you if you have alimony income or expense, student loan interest, retirement contributions, dependent care expenses, lifetime learning credit, landlord expenses, freelance expenses, charging if you have a small farm (the list is endless).

Most commercial programs also use bait and switch tactics. For example, you think you are filling out a free version and spend an hour or more filling out a form only to find a notice at the very end that to download or submit your tax forms, it will cost you $50 to $200. If you do not want to pay for the Bait and Switch, you need to start all over with a different commercial program.

A unique important benefit of OTS is that it is a community based project. If you would like to create additional forms to the project to share with the community, there is a relatively easy process where you can contribute in a way that benefits everyone.

The biggest drawback of OTS is that it does not yet include calculations for completing special case forms such as Form 8863 Educational Credits, or the Social Security Worksheet or the Child Tax Credit Worksheet. However, because it is a community based project, these and other special case forms can be added by anyone who would like to contribute to the project. In the meantime, if any special cases apply to you, you should complete these forms manually before you start OTS to complete your 1040 form. Below are instructions for completing several common special case forms.

Here is a table summarizing the most important benefits of OTS compared to common commercial tax programs.

|

Features for Free versions |

OTS |

Turbo Tax |

Tax Act |

H & R Block |

Tax Slayer |

|

Covers 1040 and includes Schedule A B C and D |

Yes |

Only 1040EZ |

simple filings |

simple filings |

Only 1040EZ |

|

Updated annually for new tax rules |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Supports all computer platforms |

Yes |

No |

Yes |

No |

No |

|

No registration required to access the free program |

Yes |

||||

|

Free version not restricted to personal use |

Yes |

||||

|

Source code available |

Yes |

||||

|

Really free for all uses |

Yes |

||||

|

Data only stored on your computer |

Yes |

||||

|

PDF printable forms easily modified with LibreOffice |

Yes |

||||

|

Community based project you can contribute to |

Yes |

||||

|

Includes calculations for special cases |

No |

||||

|

Saves filed taxes online |

No |

Yes |

Yes |

Yes |

Yes |

A final benefit of OTS is that it can empower you to a better understanding of the federal tax code. You can run as many trial tax situations as you want in order to determine the best way to lower your tax burden – both for the current tax return and to assist you with future tax returns. Thus, even if you have the money to pay for a professional to do your tax returns, you may find it better in the long run to learn how to do your own tax returns with Open Tax Solver.

Notes on Comparison of free tax preparation programs

Turbo Tax offers a free version that lets you file a Form 1040 (EZ version only) but not schedules 1, 2 or 3. You would need those schedules to report things like business income, alimony, deductible student loan interest, certain retirement contributions, alternative minimum tax, the credit for dependent care expenses, the Lifetime Learning Credit or the Saver’s Credit. If you plan to itemize, were a landlord, freelanced or ran a small business or had any other situation going on that requires filing one of these separate schedules, you’ll need to upgrade to a paid version. Sadly, the Turbotax free version is very limited and their paid version is one of the most expensive options. Also, you may not use Turbo Tax to prepare tax returns, schedules or worksheets on a professional basis (ie. for a preparer or other fee).

Tax Act offers an over-the-internet fill out form option that lets you file Form 1040 but not schedules 1, 2 or 3. Those schedules are key in the process of reporting things such as business income, alimony, deductible student loan interest, certain retirement contributions, alternative minimum tax, the credit for dependent care expenses, the Lifetime Learning Credit or the Saver’s Credit. Small business, capital gains, rents or farm income not included in free version. That means if you plan to itemize, were a landlord, freelanced or ran a small business, or had any other situations that require filing one of these separate schedules, you’ll need to upgrade to a paid version. Tax Act is also limited to consumer's personal return, does not apply if consumer uses Tax Act to prepare returns for other persons.

Tax Slayer offers a free version that lets you file a simple Form 1040 EZ form (not 1040 complete form), and not schedules 1, 2 or 3, which are important in the process of reporting things such as business income, alimony, deductible student loan interest, certain retirement contributions, alternative minimum tax, the credit for dependent care expenses, the Lifetime Learning Credit or the Saver’s Credit. And TaxSlayer imposes added requirements to file for free: Your taxable income must be under $100,000, you have to file as single or joint married, and you cannot claim dependents.

H & R Block Free version includes schedules 1, 2 and 3 in some situations. But like all of the other commercial programs, the free version is really limited to very simple tax situations. Now that you know the benefits of Open Tax Solver, let’s take a look at the steps for using Open Tax Solver to calculate and submit your federal taxes.

How to file your taxes with Open Tax Solver

Disclaimer: I am a teacher and not a professional tax accountant. If your tax adviser or accountant tells you something different or you read something different in an IRS publication, then listen to the professionals and not to me. I am merely explaining how I use Open Tax Solver and how I teach it to my students.

Step 1: Gather all of your tax documents.

Most tax documents must be mailed to you by the end of January each year. However, some documents may not arrive until late February. So March is a good month to do your taxes.

These tax documents might include:

#1 W2 forms from any employers you worked for as an employee.

#2 1099 Taxable Interest Income statements

#3 1099 SSA Social Security Income statement

#4 1099 – MISC Consulting and other business income.

#5 9595 – Book Royalty Misc Income to report on Schedule E

#6 1098 T Student Tuition expenses (deductible even if not itemizing deductions)

#7 1098 E Student Loan Interest (deductible even if not itemizing deductions)

#8 1098 Mortgage Interest Paid if using Schedule A to itemize deductions.

#9 Other deductions from contributions to churches and 501c3 organizations if using Schedule A to itemize deductions.

#10 Extreme medical expenses if using Schedule A to itemize deductions.

#11 1095 C Employer Provided Health Insurance Coverage Verification

Copies of these documents should be attached to the end of your tax return when done.

Step 2: Download the current IRS Tax Preparation Booklet

Once you have your tax documents, you should download a couple of additional documents before starting your taxes. OTS is intended to be used with the IRS annual tax booklet. Sadly, this monster is 108 pages long. The good news is that you will only need to read a few pages of it and OTS will do all of the actual calculations for you. Here is a link to download the current version: https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

You should also download the current year IRS form 1040. Here is the link: https://www.irs.gov/pub/irs-pdf/f1040.pdf

It is also useful to have a copy of your previous years tax return as it is likely your new return will be similar to your previous years return.

It is also helpful to download and print out a hard copy of form 1040 as well as any special forms you will be completing such as Schedules 1, 2 and 3.

Also if you have business expenses, you should download and print out a hard copy of Schedule C, Schedule SE and form 8995.

I also printed out Schedule E (supplemental income), the Social Security Worksheet 1 (IRS Publication 915 Page 16), Educational Credits form 8863 and Child Tax Credit worksheet which is pages 6 and 7 of IRS Publication 972.

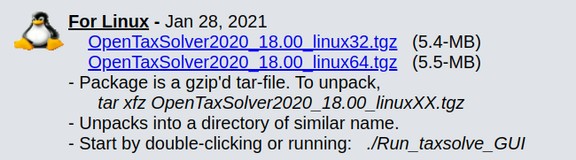

Step 3: Download Open Tax Solver

Go to this page:

https://sourceforge.net/projects/opentaxsolver/files/OTS_2020/v18.07_linux/

Then download the version for Linux 64:

This will place a compressed version of the program in your Downloads folder. Open your file manager.

Then create a new folder called 2020 Taxes and transfer the program to the new folder. Then uncompress it with a right click and click on Extract Here. Then open the extracted folder and click on Run Tax Solve GUI to open it. Below is what the opening screen will look like:

Step 4: Complete any Special Case Forms Before Starting your 1040 form

If you have any business income or expenses, select US 1040 Schedule C and complete Schedule C first. (see Step 14)

Also complete Schedule SE (see Step 15)

Then complete Form 8995.(see Step 16)

Then complete Schedule E. (see Step 17)

Then complete the Social Security Worksheet 1 (see Step 18)

Then complete the Educational Credits Form 8863 (see Step 19)

If you have dependents, you should do the Child Tax Credit Worksheet after completing all of the other special case forms but before completing your 1040 form. (see Step 20)

Step 5: Open a New Tax Document

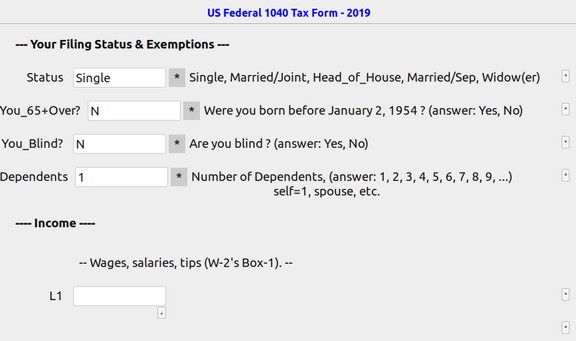

To do the common Federal 1040 tax return, select US 1040 (with Schedules A, B and D). Then click Start New Return. This screen will appear.

Use the drop down to select your filing status, age bracket and number of dependents. If you are not sure if you can claim a child as a dependent, you can read the IRS Tax Manual section on dependents.

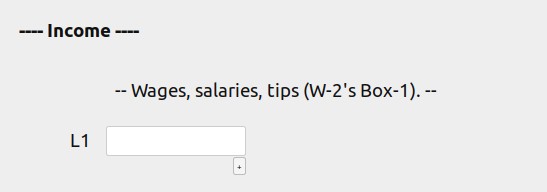

Step 6 Complete Income Section

There are several types of income. This includes Income, Interest and several others. Wages is from Line 1 of any W-2 forms you have.

If you have two jobs and two W-2 forms, then click on the Plus sign (+) just below the L1 box to create a second L1 box. The number you enter is from your W-2 Line 1. If you need to add a comment, click on the plus sign to the right of any box.

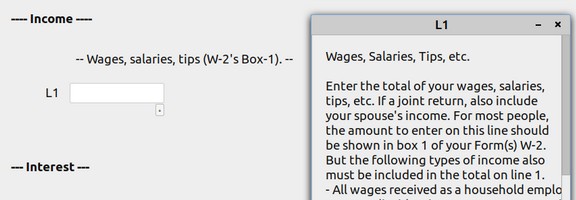

To learn more about what to enter, click just to the right of most boxes to bring up a helpful tips screen:

Taxable Interest: Enter the total from any 1099-INT forms you have.

Other Income: IRA Distributions, Pensions, etc: Your retirement account adviser should be able to help you with these lines.

Social Security Benefits: Enter the amount from box 5 from the SSA – 1099 form

Qualified Business income deduction: If you have a business, you likely can deduct 20% of the income on this box. But for now, leave it blank until after you have completed either Form C or form C-EZ.

Child Tax Credit: Consult the IRS Manual on this one.

Federal Income Tax Withheld: Amount from Box 2 of your W-2 forms.

Step 7: Complete Schedule 1 Additional Income

There are several types of additional income. If you have a small business, you should complete Schedule C or Schedule C-EZ. Your business income and expenses are provided on this form. Only the total (income minus expenses) is entered on the S1_3 box.

For now, we will leave this box blank and fill it in after we discuss Schedule C at the end of this tutorial.

If you rent a part of your house, then fill out Schedule E which is the Rental income minus the rental expenses. If you have a farm that generates income, fill out Schedule F. If you received Unemployment Income, then it goes in the box S1_7.

Step 8: Complete Adjustments to Gross Income

Educator expenses: Teachers often spend massive amounts of their income on their students or on educator training. Consult the IRS manual for what to put here.

Deductible Part of Self Employment Tax: If you are self-employed, you need to tax yourself. Complete Schedule SE. We will leave this blank and cover self employment tax with Schedule C.

You can also deduct money you put into an IRA, student loan interest and tuition and fees if you went to school.

Step 9: Complete Tax and Credits

You have two options. You can itemize deductions by completing schedule A. Or you can take the standard deduction. If you do not earn a lot of money, or own an expensive home with a big mortgage, you may be better off talking the new and much larger standard deduction than itemizing all of your deductions. You can try it both ways. But to itemize now, your total deductions need to more than $12,200 for an individual, or more than $18,650 for a head of household or more than $24,400 for a married couple filing jointly and more than $13,500 for a retired individual and more than $27,000 for a retired couple. Our standard deduction is 24,400 plus 1,300 since only I am retired while my wife is not. For our first trial run, we will just leave these boxes blank and see if OTS determines the standard deduction for us. We will also leave Schedule 2 and 3 blank for now. We will also leave Auto file blank for now but then fill this section in when we are ready to print our final form.

Step 10: Save your 1040 form

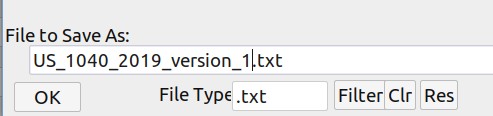

After you finish entering all your data and filling out the entire form, save it by clicking the Save button at the bottom of the screen. Give the file a descriptive name like US_1040_2019_ version 1.

Click OK to save the text file.

Step 11: Computer your tax and fix any errors

After you save the file, click Compute Tax at the bottom of the screen. A screen called Results will appear. Scroll to the bottom of the screen. It will indicate the total tax due and the total payments and the amount of any refund or remaining amount still due. If you make a mistake, often it will appear as a Data Error at the bottom of the Preview Results screen. The preview also reports your marginal tax rate and what percentage of your income you are paying in taxes.

Step 12: Complete Schedule A to see if itemizing deductions is greater than taking the standard deduction

Line 4: Enter this amount only if your actual medical expenses were greater than 7.5 % of your total income.

Line 5a: Enter the amount of state income and sales tax you paid.

Line 5b: Enter the amount of real estate taxes you paid.

Line 5d: Enter the total of Lines 5a and 5b.

Line 5e: If 5d is greater than the allowed amount, enter the allowed amount here. Otherwise, enter the amount from Line 5d.

Line 7: enter the amount from Line 5e.

Line 8a: Enter the home mortgage interest here and on line 10.

Line 11: Enter gift amounts to 501c3 charities here. If over $500, include Form 8283, Also enter on Line 14.

Line 17: Total of Line 7, 10 and 14. If this amount is less than the standard deduction, then do not itemize deductions.

Step 13: Print forms to sign and mail

If you do not have any business income, you may be done. If this is the case, click Fill-out PDF Forms, and it will provide printable tax forms with all of your information filled in. If you entered your name, address, and social security number when entering your data, all of that information will also appear in the right places on the form. Double-check everything, print it, compare it with your previous years tax form and mail your tax return to the IRS. Mailing your forms to the IRS is a much more secure option than e-filing.

Part II Instructions to Complete Special Case forms

Step 14: If you have business income, complete Schedule C or C-EZ.

Close the results screen. Also exit the program. Then start it again and this time choose 1040 Schedule C. Then click Start New Return. If you completed Schedule C the previous year, you should also compare the current year to the previous year Schedule C. Here is a link to download the IRS manual for Schedule C. It is 18 pages long. https://www.irs.gov/pub/irs-pdf/i1040sc.pdf

You should also print out the actual Schedule C to see what the final result will look like. Here is the link for this. https://www.irs.gov/pub/irs-pdf/f1040sc.pdf

I used Schedule C-EZ in the past. However, form C-EZ is limited to business expenses of less than $5,000. Since I had business expenses of more than $5,000 this past year (2020), I now need to fill out Schedule C.

Your Business Information

You do not need a Business Name or Business EIN to complete schedule C or C-EZ. However, if you have employees and or want a business bank account or you make 1099 payments, you should file your business with the state and also get a federal EIN number. My business type is an informal sole proprietorship. Just enter your name and Social Security number. For principal business, I called it Consulting – which is a service business. I left the business name blank. I used my personal address as my business address. The business activity code for consulting is 541990.

Accounting Method: If your business is very small, you can use the cash method of accounting where you just pay as you go and declare expenses as they occur and do not have to worry about calculating depreciation. My business is very small and I am using the cash method of accounting.

Income and Expenses

Gross Receipts: Enter the total of all of the money your business made in 2019.

Advertising Expense: Enter your advertising expense on Line 8.

Should you complete the business mileage section?

You currently can deduct 58 cents per mile for every business mile you drive. This includes to and from your place of occupation. Do not enter this on Line 9 (which is for other car expenses). Instead, just enter your total business miles in the Miles box for Line 9 and the program will calculate the total business expense for these miles.

Office Expense: Should you declare a Business Office in your home?

You can deduct the cost of your home office at $5 per square foot up to a maximum of $500 per year. It must be used exclusively for your business. You can alternatively deduct the actual cost of your home office including deducting a portion of your energy bills and everything else. This is only useful if your home office takes up a significant fraction of your home and you are willing to keep very accurate records of all of your home expenses. If you use the detailed method of calculating business use of home, you need to complete form 8829 and list the result on Line 30.

Supplies (not in Part III) Line 22 Put items here that are not inventory

Part III Inventory This is for those whose business requires an inventory.

Total Business Expenses Total business expenses include Advertising, Mileage, Office, Supplies and Inventory and whatever else you spent money on to support your business.

Business income or profit equals total income minus total expenses.

This amount is used for Schedule SE and for form 1040.

Step 15: Complete Schedule SE to determine your self employment tax

Download the instructions for IRS schedule SE. It is 6 pages. Here is the link:https://www.irs.gov/pub/irs-pdf/i1040sse.pdf

Also download and print the actual form for Schedule SE. Here is the link: https://www.irs.gov/pub/irs-pdf/f1040sse.pdf

The profit on your business is basically your self employment. Enter the net profit from Schedule C on Line 2 and line 3. Then multiple Line 3 times .9235. If it is less than $400, you do not owe self employment tax and can skip this form.

Line 5 Self Employment Tax: Multiple Line 4 by 15.3 percent. Enter the result on Line 5 and on Schedule 2 Line 4.

Line 6: Deduct one half of self employment tax. Multiply Line 5 by 50 percent. Enter the result on Line 6 and on Schedule 1 Line 27.

Step 16: Complete the Simplified Qualified Business Income Component Worksheet

You can usually lower the amount of business income subject to federal taxes by about 20% by completing the Simplified Qualified Business income Worksheet. The deduction is available, regardless of whether taxpayers itemize deductions on Schedule A or take the standard deduction. It reduces the lesser of taxable income or business income and is generally 20% of a taxpayer's qualified business income (QBI)

There are two ways to calculate the QBI deduction: Using the simplified worksheet and the complex worksheet.

This Simplified Worksheet can be found in the Instructions for Form 1040 and is a straightforward calculation. see page 50

Qualified Business Income will consist of the income or loss that is reported on any of the following tax schedules: Schedule C (Form 1040), Line 31 – Net Profit (or Loss)

20% of the Qualified Business Income from the trade or business. If there are multiple pass-through businesses reported on the return, the QBI Component is determined separately for each business.

Fill out form 8995. Here is the link

https://www.irs.gov/pub/irs-prior/f8995--2019.pdf

Step 17: Complete Schedule E Supplemental Income and Loss

Schedule E is for income that is not part of your W-2 income and not part of your business income. For example, you may get royalty income for a book you wrote. This is entered on Line 4, Line 21, Line 23b, Line 24 and Line 26 of this form. Also enter this amount on Schedule 1 Line 17.

Step 18: Complete Form 8863 Educational Credits

This is where we calculate the deduction for our daughters educational expense. Here is the link to download the instructions for this form: https://www.irs.gov/pub/irs-pdf/i8863.pdf

Here is a link to download and print the actual form:

https://www.irs.gov/pub/irs-pdf/f8863.pdf

To claim the American opportunity credit, you must provide the educational institution's employer identification number (EIN) on your Form 8863.

For 2019, you may be able to claim a tax credit of up to $2,500 for adjusted qualified education expenses paid for each student who qualifies. A tax credit reduces the amount of income tax you may have to pay. Unlike a deduction, which reduces the amount of income subject to tax, a credit directly reduces the tax itself. Forty percent of the American opportunity credit may be refundable. This means that if the refundable portion of your credit is more than your tax, the excess will be refunded to you.

Qualified expenses include tuition, required enrollment fees, and course materials that the student needs for a course of study whether or not the materials are bought at the educational institution as a condition of enrollment or attendance.

The amount of the American opportunity credit (per eligible student) is the sum of 100% of the first $2,000 of qualified education expenses you paid for the eligible student, PLUS 25% of the next $2,000 of qualified education expenses you paid for that student. The maximum amount of American opportunity credit you can claim in 2019 is $2,500 multiplied by the number of eligible students.

You claim the American opportunity credit by completing Form 8863 and submitting it with your Form 1040 or 1040-SR. Enter the nonrefundable part of the credit on Schedule 3 (Form 1040 or 1040-SR), line 3. Enter the refundable part of the credit on Form 1040 or 1040-SR, line 18c

The American Opportunity Credit is better than Lifetime Learning Credit but is limited to a total of only 4 years. You can only take one or the other – not both – for any given student on any given year.

The amount of the lifetime learning credit is 20% of the first $10,000 of qualified education expenses you paid for all eligible students. The maximum amount of lifetime learning credit you can claim for 2019 is $2,000 (20% × $10,000).

What is the tax benefit of the tuition and fees deduction? The tuition and fees deduction can reduce the amount of your income subject to tax by up to $4,000. This deduction is claimed as an adjustment to income on Schedule 1 (Form 1040 or 1040-SR). This deduction may be beneficial to you if you don't qualify for the American opportunity or lifetime learning credits.

Step 19: Deduct student loan interest from form 1098-E on federal 1040 taxes

Student loan interest can be deductible on federal tax returns, but receiving a 1098-E doesn't always mean you're eligible to take the deduction. If you're married filing separately, or for 2019 if your modified adjusted gross income is $85,000 or more if filing single or $170,000 if married filing jointly, you can't deduct any student loan interest.

Your lenders are required to send you Form 1098-E only if you paid at least $600 in interest during the year. The student loan interest deduction is taken as an adjustment when calculating your adjusted gross income (see Schedule 1 Part II Line 20and 1040 line 8a). You do not have to itemize your deductions to take it. Regardless of how much interest you paid, the maximum student loan interest you can deduct is $2,500.

Step 20: Social Security Benefits Worksheet

You can usually lower the amount of Social Security benefits subject to taxes by about 15% by completing the Social Security benefits worksheet. See page 7, 8, 9 and 10 of this IRS document https://www.irs.gov/pub/irs-pdf/p915.pdf

Step 21: Calculate the Child Tax Credit

This is worth about $500 (up to $2000 per child). The Child Tax Credit (CTC) is designed to give an income boost to the parents or guardians of children and other dependents. In the past, it only applied to dependents who were younger than 17. However, you can now get $500 per year for dependents who are older than 17.

As a reminder, tax credits directly reduce the amount you owe the IRS. So, if your tax bill is $3,000 but you’re eligible for $1,000 in tax credits, your bill is now $2,000. This differs from a tax deduction, which reduces how much of your income is subject to income tax.

The Child Tax Credit is also refundable up to $1,400. That means if you qualify for the Child Tax Credit and it brings your tax liability (how much you owe) below zero, the IRS will still send you the remaining amount of the credit, up to $1,400. There is now a $500 (non-refundable) credit available for each non-child dependent even if they are over 17.

Eligible filers can claim the Child Tax Credit on Form 1040, line 12a. To help you determine exactly how much of the credit you qualify for, you can use the Child Tax Credit and Credit for Other Dependents Worksheet provided by the IRS.

https://www.irs.gov/pub/irs-pdf/p972.pdf#page=6

Step 22: Complete Schedule 1 Additional Income

Additional income includes royalty payments on any books you have written and published. This needs to be done after completing schedule C, Schedule E and schedule SE.

Step 23: Complete Schedule 3 Nonrefundable Credits

This includes deducting your students tuition credit. First complete form 8863 and enter line 19 on Schedule 3 Line 50 and Line 55.

Step 24: Complete Schedule 4 Other Taxes

Complete Schedule SE to determine your self employment tax. Then enter the result on Schedule 4 Line 57 and 64.

Forms completed separately:

8863 Education Credits

Schedule 3 line 3 (non-refundable education credit)

Schedule C Profit or Loss from Business

Qualified Business Income Deduction simple version

Schedule SE Self Employment Tax (short version)

Schedule 4 has been discontinued by the IRS beginning with the 2019 income tax year. The information entered previously on Schedule 4 has been added to Schedule 2.

Schedule 2

Schedule E Supplemental Income (royalty to schedule 1 line 5)

Schedule 1 (total to 1040 line 6)

Social Security Benefits Worksheet 1

Child Tax Credit Worksheet

Last will be 1040 rough draft and compare to last year.

Notes on completing OTS 1040 form:

You can do a manual calculation of 1040 and then use your entries to complete the program fill in boxes. If using the standard deduction, do not fill in any of the boxes in Schedule A. OTS will calculate the standard deduction for you. When you click Compute Tax, the program will automatically calculate the Social Security Worksheet for you. Review the Results. Then click Fill out PDF forms. Then click Open in PDF Viewer.

Step 24: Print and compare your entire return with your previous years return

Then make any adjustments to your current year return based on your previous years return. In my case, I had made two minor math errors in my manual calculations. OTS caught both of these math errors and corrected them.

In addition, my hand writing is not the best and my numbers can be hard for others to read. OTS printed out a professionally typed return. I reviewed all of the calculations it made compared to the calculations I had made and OTS did a better job of calculating my tax return than I had done.

The only correction I needed to make to the printed form was to add the name and social security number of my dependent on Page 1 of the 1040.

It printed out 1040 (2 pages), Schedules 1, 2, 3 ,Schedule B and C (2 pages).

I needed to add my manually filled out forms for Schedule E, Schedule SE, Form 8863 (education credit), and Form 8995 (Qualified Business Income Deduction).

Step 25: Complete your final return, print it, sign it and mail it in.

Also send in copies of all of your tax forms including your W-2, 1099s, 1098s, 1095C (Health Insurance Verification form) and any other forms you filled out showing how you determined your taxes.

Congratulations! You are done!

You are not only done with your taxes for another year – but you also have a system for completing your taxes even faster in future years. Best of all, you data is safe on your own computer.